Coal India may cut supplies to NTPC as quality row escalates - Quoted in the Economic Times

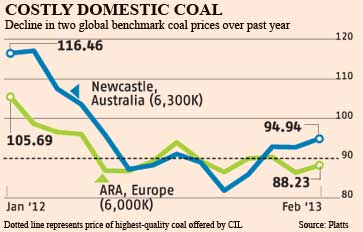

The row underscores the difficulties India faces in extracting coal quickly and efficiently enough to eliminate power shortages that hurt economic growth, and to reduce its reliance on costlier imports.

The head of Eastern Coalfields Limited (ECL), a subsidiary of Coal India, the world's largest coal mining company, said on Friday it could halt supplies to two plants of NTPCBSE 1.85 % after the latter stopped paying the full price for shipments.

Power producer NTPC has long complained it is forced to accept coal that is heavily adulterated with rocks and stones for its plants, hurting output and slowing the signing of new contracts.

An NTPC official, who did not want to be identified because of the sensitivity of the matter, said the company had "taken a stand" against its supplier, but added that it expected Coal India to revolve the dispute soon.

R. Sinha, the chairman and managing director of ECL, said the Coal India unit had been forced to cash in fixed deposits to pay employees' salaries, to make up for the fact that NTPC's non-payments amounted to 10 billion rupees ($182 million).

"We are open-minded. If NTPC resolves the issues, they can get coal as they were getting. We can't keep coal at our pithead because it will catch fire. So, we have to stop production if they don't resolve the issues," he said.

"If this month again I have to encash some of the fixed deposits, then I have to stop their coal supply, if they don't pay us our dues," he added.

QUALITY CONTROL

India sits on the world's fifth-largest coal reserves. But state-controlled mining operations are riddled with corruption and the theft of good quality coal by criminals colluding with Coal India officials and police, a parliamentary panel said last year.

A massive blackout last July, when power was cut for two consecutive days in a massive area home to 670 million people, showed how far the country still has to travel in terms of providing reliable power.

NTPC gets the bulk of its coal through long-term fuel supply agreements (FSAs) with Coal India. The utility has delayed signing a new supply pact for 4,500 MW, however, citing quality issues, its chairman said in February.

ECL supplies coal from its Rajmahal mine in Jharkhand state to NTPC's Kahalgaon and Farakka plants, and plans to expand the mine's capacity to 17 million tonnes from 14 million tonnes could be scuppered if NTPC does not pay its dues, Sinha said.

"We have taken a stand," an NTPC official said by telephone, acknowledging the company had not paid in full for the coal supplies but declining to give specifics.

"We've always had issues with supplies there," the official said about coal shipments in India's east. ECL is headquartered in the eastern state of West Bengal, where it has mines, as well as in neighbouring Jharkhand.

"Coal India is also an equally responsible organisation. I think they will very soon come up with a good plan," the official said, without saying how a compromise could be reached.

Both coal supplier and power producer now jointly monitor the quality of coal extracted from mines, opening up the possibility of wrangles over its true worth. The government plans to change that by mandating a third party to judge value.

Dipesh Dipu, a partner at Jenissi Management Consultants, played down the chances of the dispute escalating to the point where Coal India would pull the plug on supplies and cause mass power shortages.

"I don't suspect it will lead to that kind of extreme measures, because at the end of the day, both public sector entity heads are responsible to their political bosses."